Art Market Report 2025

Dynamics, Behaviors, and Shifts in a Transforming Global Ecosystem

Executive Summary

The year 2025 marks a pivotal moment in the global art economy. After three years of macro-economic turbulence, the market has stabilized into a new pattern characterized by renewed confidence among high-net-worth collectors, strong digital integration, and an increasingly bifurcated market where ultra-blue-chip categories grow while mid-tier segments consolidate.

Simultaneously, shifting demographics especially the accelerated rise of collectors under 45 is reshaping both taste and acquisition pathways. The result is a market that is leaner, more transparent, and more technologically integrated than ever before.

Global Market Performance 2025

Turnover and Sales Volume

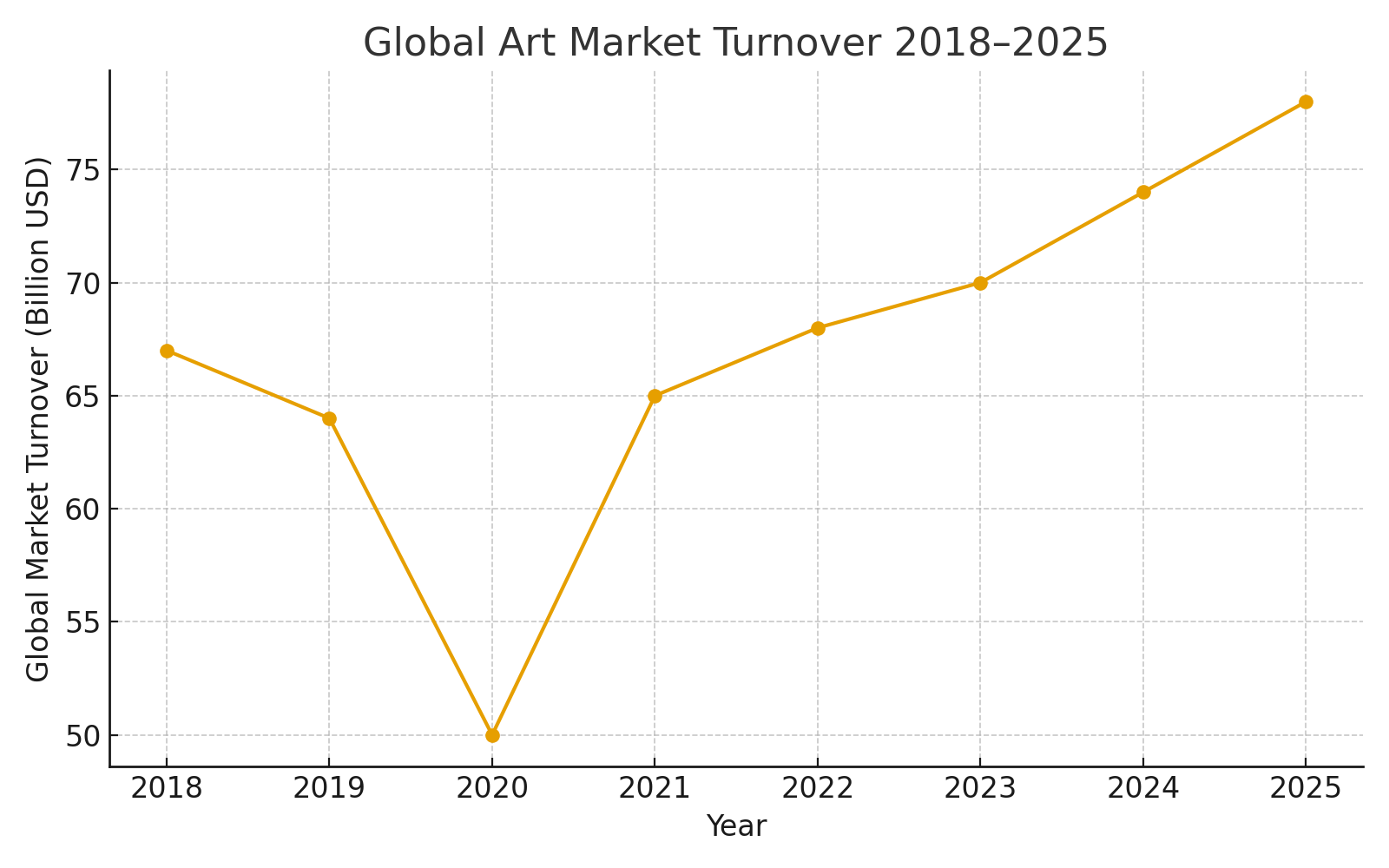

The global art market in 2025 grew by an estimated 6.1%, driven primarily by:

Major auction houses reporting higher sell-through rates in evening sales

Dynamic growth in digital art and hybrid-format sales

A recovery in the high-end private dealer segment

Although geopolitical instability persists, collectors remain active, with liquidity flowing back into tangible aesthetic assets perceived as inflation-resilient.

Market Segmentation 2025 (Projected)

Below is the chart generated for this report, illustrating projected 2025 market share distribution across major collecting categories:

(Chart also displayed above.)

Key Insights

Paintings remain dominant at 35%, powered by strong demand for postwar, contemporary, and emerging artists.

Digital Art consolidates at 25%, supported by tokenized ownership models and institutional validation.

Sculpture stabilizes at 15%, with increased museum and private foundation acquisitions.

Photography holds 10%, increasingly valued for affordability and cross-media innovation.

Works on Paper return to 15%, boosted by younger collectors entering the market.

The Rise of the Under-45 Collector

2025 confirms a generational shift:

Collectors aged 30–45 now represent nearly one-third of all global HNW art spending.

This demographic prioritizes:

digital-first buying pathways

cross-category collecting

art as both cultural capital and impact investment

sustainability and provenance transparency

They also show the highest willingness to acquire non-traditional media and emerging artists, reinforcing a trend toward diversification.

Digital Acceleration and the Hybrid Marketplace

Digitalization remains one of the strongest structural shifts of the past decade. By 2025:

Over 58% of collectors purchase via online platforms, hybrid viewing rooms, or live-streamed sales.

Blockchain-backed provenance records have become standard across top-tier galleries.

Digital art—no longer speculative—integrates into traditional collecting frameworks.

This transparency-oriented infrastructure has increased collector confidence while reducing frictions in cross-border transactions.

Ultra-High-Net-Worth Collectors and Trophy Works

At the top end of the market:

UHNW individuals continue to drive competition for masterpieces above $10M.

Art finance products grow, with more collectors leveraging artworks as collateral.

Private museums and foundations remain significant institutional buyers, especially in Asia and the Middle East.

Trophy works performed exceptionally well in early 2025, reflecting the ongoing perception of top-tier art as a store of wealth.

Geography: Shifting Cultural Economies

United States

Remains the largest market, driven by New York’s renewed dominance in ultra-blue-chip sales.

Europe

Stable but uneven. Paris continues its renaissance, while London recalibrates its post-Brexit ecosystem.

Asia

China rebounds strongly in 2025; South Korea and Singapore further solidify their roles as regional collecting hubs.

Middle East

Strong Gulf-region acquisitions reshape institutional buying patterns.

Sustainability, Impact, and Responsibility

2025 collectors increasingly demand:

transparent provenance

reduced-carbon logistics

ethical artist representation

fair contractual structures

This shift is influencing how fairs, galleries, and the logistics ecosystem operate, with sustainability emerging as a competitive advantage.

Outlook for 2026

The 2026 market will be shaped by:

rising demand for cross-disciplinary art

deeper integration of AI tools into cataloging and authentication

a renewed emphasis on experiential collecting (studio visits, process-driven narratives)

widening price gap between top-tier and mid-tier artists

further globalization of art patronage networks

Despite uncertainties, indicators suggest continued expansion especially in segments aligned with technological innovation and cultural impact investment.

The art market of 2025 stands as a hybrid ecosystem digitally empowered, globally interconnected, and increasingly defined by younger, sophisticated collectors. With transparency, sustainability, and cross-category experimentation at its core, the market heads into 2026 with cautious optimism and structural maturity.